Graywood’s Guide to

THE FIRST TIME BUYER INCENTIVE PROGRAM

Applications now being accepted by Government of Canada!

The Government of Canada has a total amount of funding will be $1.25 billion over 3 years.

If approved for the Incentive, the purchase transaction must close on or after November 1, 2019

* Program is subject to change without notice

What is the Government offering?

• 5% of a first-time buyer’s purchase of existing homes

• 5% or 10% of a first-time buyer’s purchase of a new build Theodore qualifies for this incentive!

For Example

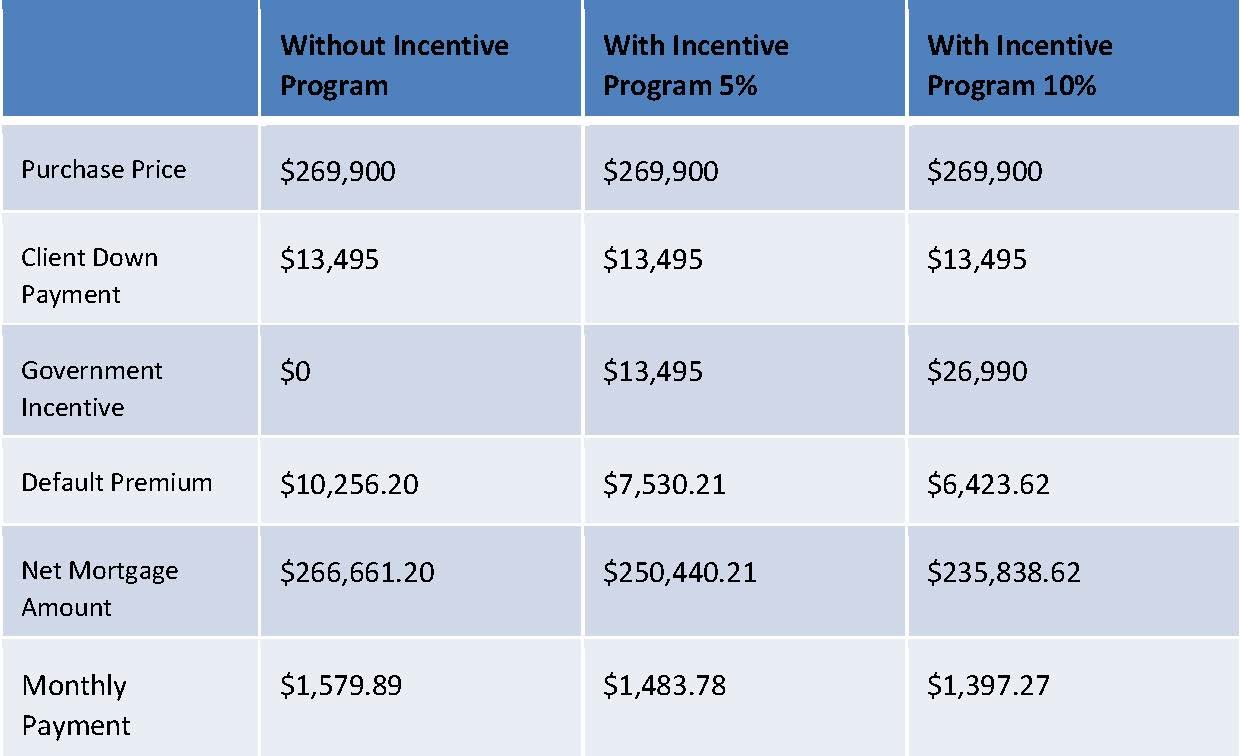

You would like to purchase our B1 Plan at The Theodore for $269,900

Your Annual Income is $70,000

$280,000 is your maximum purchase price based on your annual income ($70,000 x 4= $280,000)

• Under the First-Time Home Buyer Incentive, you can apply to receive $28,000 in a shared equity mortgage (10% of the cost of a new home) from the Government of Canada. This lowers the amount you need to borrow and reduces your monthly expenses. The Incentive is a second mortgage on the title of the property, however unlike a mortgage, there are no regular principal payments, it isn’t interest bearing and has a maximum term of 25 years.

You are eligible to apply for the incentive if you

• do not exceed a maximumqualifying household income of $120,000

• have never purchased a home before (at least one borrower must be a first-time homebuyer)

• have gone through a breakdown of a marriage or common-law partnership (even if you don’t meet the other first-time home buyer requirements)

• in the last 4 years, you did not occupy a home that you or your current spouse or common-law partner owned

How does the 4-year period work?

- The 4-year period begins on January 1st of the fourth year before the Incentive is fundedand ends 31 days before the date the Incentive is funded

- if you sold your home you lived in in 2014, you may be able to participate in 2019 or if you sold the home in 2015, you may be able to participate in 2020

Want to Sell Your “First Home” or Pay-back the Incentive?

• The first-time homebuyer will be required to repay the Incentive amount after 25 years or when the property is sold, whichever comes first.

• The homebuyer can also repay the Incentive in full at any time, without a pre-payment penalty. Refinancing of the first mortgage will not trigger repayment

• If a homebuyer receives a 5% or 10% Incentive, the homebuyer will repay 5% or 10% of the home’s value at repayment

• Repayment is based on the property’s fair market value

• The Government of Canada will share in the upside and downside of the property value upon repayment

*Information provided by Bank Of Montreal and is subject to change without notice